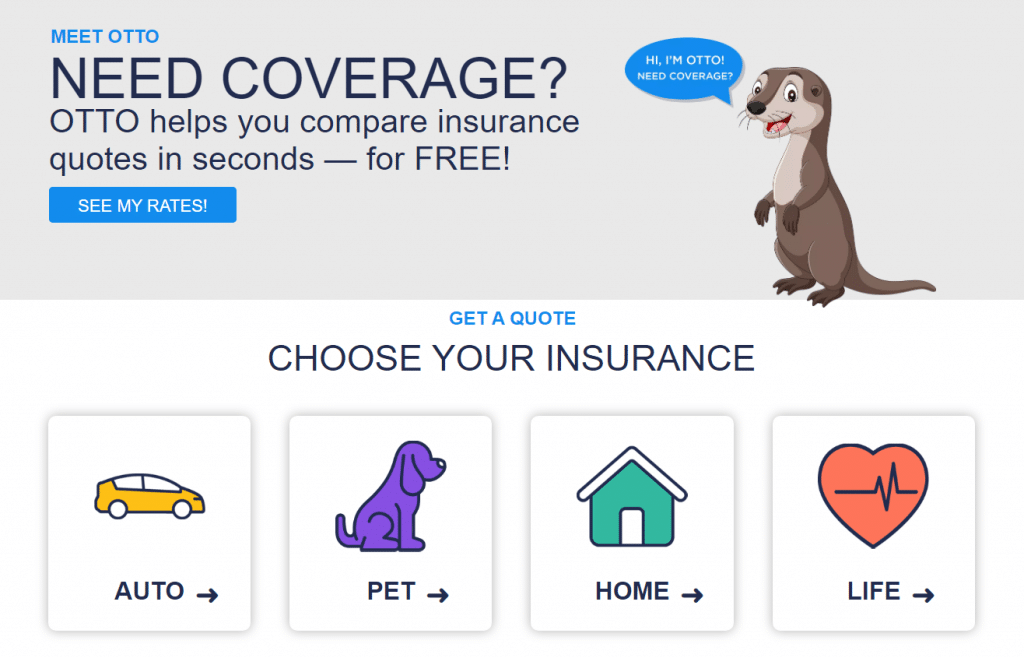

If you are looking for a way to save money on your insurance premiums, you might have come across Otto Insurance. Otto Insurance is a website that claims to help you find the best rates for auto, home, pet, life, and commercial insurance. But what is Otto Insurance exactly? How does it work? What type of insurance does it offer? How can you get a quote from Otto Insurance? Is Otto Insurance a scam or a legit service? What are the reviews and ratings of Otto Insurance? What states does Otto Insurance cover? What are the pros and cons of Otto Insurance? In this blog post, we will answer all these questions and more. Read on to find out everything you need to know about Otto Insurance.

What is Otto Insurance?

Otto Insurance is not an insurance company, but a lead-generation site that connects customers seeking different types of insurance with its partners. Joshua Keller founded the company and it’s a wholly-owned subsidiary of Global Agora, a venture capital firm. Otto Insurance aims to provide quick and free online insurance quotes for customers who want to save money and time on their insurance needs. Otto Insurance claims to have access to over 100 top-rated insurance carriers and agents across the country, and to use advanced technology and data science to match customers with the best insurance options for their situation.

How does Otto Insurance work?

Otto Insurance works by asking customers to take a short quiz on its website, where they have to provide some basic information about themselves and their insurance needs. Based on the answers, Otto Insurance generates a personalized quote for the customer, which they can compare with other quotes from different providers. If the customer likes the quote, they can click on it and be redirected to the partner’s website, where they can complete the purchase of the insurance policy. Alternatively, the customer can also request a call from an agent who can assist them with the purchase process. Otto Insurance does not charge any fees or commissions from the customers for using its service. However, it does receive compensation from its partners for generating leads for them.

What type of insurance does Otto offer?

Otto offers quotes for five types of insurance: auto, home, pet, life, and commercial. Here is a brief overview of each type of insurance:

• Auto insurance:

Auto insurance covers the financial losses that may arise from accidents involving your vehicle. It can include liability coverage, which pays for the damages you cause to others; collision coverage, which pays for the damages to your own vehicle; comprehensive coverage, which pays for the damages caused by theft, fire, vandalism, or natural disasters; personal injury protection (PIP), which pays for your medical expenses and lost wages; uninsured/underinsured motorist (UM/UIM) coverage, which pays for your damages if the other driver is at fault and has no or insufficient insurance; and other optional coverages such as roadside assistance, rental reimbursement, gap insurance, etc.

• Home insurance:

Home insurance covers the financial losses that may arise from damage or destruction to your home and personal property. It can include dwelling coverage, which pays for the repairs or rebuilding of your home; personal property coverage, which pays for the replacement of your belongings; liability coverage, which pays for the damages you cause to others on your property; loss of use coverage, which pays for your living expenses if you have to move out of your home temporarily; and other optional coverages such as flood insurance, earthquake insurance, identity theft protection, etc.

• Pet insurance:

Pet insurance covers the veterinary expenses that may arise from illness or injury to your pet. It can include accident-only coverage, which pays for the treatment of accidental injuries; accident and illness coverage, which pays for the treatment of both accidental injuries and illnesses; wellness coverage, which pays for routine care such as vaccinations, dental cleaning, spaying/neutering, etc.; and other optional coverages such as alternative therapies, behavioral issues, prescription food, etc.

• Life insurance:

Life insurance covers the financial losses that may arise from your death. It can include term life insurance, which pays a lump sum benefit to your beneficiaries if you die within a specified period; permanent life insurance, which pays a lump sum benefit to your beneficiaries whenever you die and also accumulates cash value over time; and other optional coverages such as accidental death and dismemberment (AD&D), disability income protection (DIP), long-term care (LTC), etc.

• Commercial insurance:

Commercial insurance covers the financial losses that may arise from your business operations. It can include general liability insurance, which pays for the damages you cause to others as a result of your business activities; property insurance, which pays for the damages to your business property; workers’ compensation insurance, which pays for the medical expenses and lost wages of your employees who get injured on the job; business interruption insurance, which pays for your lost income if your business is disrupted by a covered event; and other optional coverages such as professional liability insurance, cyber liability insurance, commercial auto insurance, etc.

How to get an insurance quote from Otto Insurance

Getting an insurance quote from Otto Insurance is easy and fast. All you have to do is follow these steps:

• Visit the Otto Insurance website and choose the type of insurance you want to get a quote for.

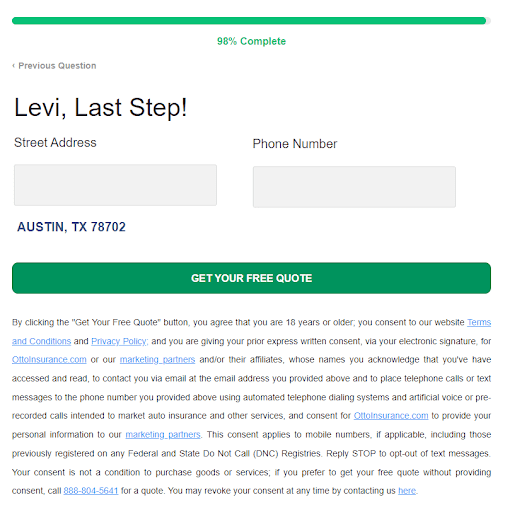

• Take the short quiz and answer some basic questions about yourself and your insurance needs. The quiz will take less than 5 minutes to complete.

• Compare the quotes that Otto Insurance generates for you based on your answers. You can see the name of the provider, the monthly premium, the coverage details, and the customer ratings for each quote.

• If you like a quote, click on it and you will be redirected to the partner’s website, where you can complete the purchase of the policy. Alternatively, you can also request a call from an agent who can assist you with the purchase process.

Is Otto Insurance a scam?

Otto Insurance is not a scam, but a legitimate service that helps customers find affordable quotes for their insurance needs.

However, there are some things that you should be aware of before using Otto Insurance:

• Otto Insurance is not an insurance company, but a lead-generation site that connects customers with its partners. Therefore, Otto Insurance does not sell or provide any insurance policies, nor does it handle any claims or customer service issues. If you have any questions or problems regarding your policy, you will have to contact the partner directly.

• Otto Insurance does not guarantee that the quotes it generates are accurate or up-to-date. The quotes are based on the information that you provide in the quiz, which may not reflect your actual situation or needs. Therefore, you should always verify the quotes with the partner before purchasing a policy.

• Otto Insurance does not endorse or recommend any of its partners or their products. The quotes are ranked by price only, and do not take into account other factors such as coverage quality, customer satisfaction, financial strength, etc. Therefore, you should always do your own research and compare different options before choosing a policy.

• Otto Insurance does not protect your personal information or privacy. By using Otto Insurance, you agree to share your personal information with its partners and third parties for marketing purposes. You may receive unsolicited calls, emails, texts, or mail from these parties, which may be annoying or intrusive. Therefore, you should always read the privacy policy and terms of service of Otto Insurance and its partners before using their service.

Also Read: TrueRate Commercial Loan Service

Otto Insurance reviews and ratings

Otto Insurance has mixed reviews and ratings from customers and experts. On one hand, some customers praise Otto Insurance for providing quick and easy quotes for their insurance needs. They also appreciate the variety of options and providers that Otto Insurance offers. On the other hand, some customers complain about receiving inaccurate or misleading quotes from Otto Insurance. They also report being harassed by spam calls or emails from their partners and third parties. Here are some examples of Otto Insurance reviews and ratings from different sources:

• On Facebook, Otto Insurance has a rating of 4.6 out of 5 stars based on 1 review. The reviewer says that Otto Insurance helped him save money on his auto insurance.

• On Trustpilot, Otto Insurance has a rating of 2 out of 5 stars based on 3 reviews. The reviewers say that Otto Insurance gave them wrong or outdated quotes and that they received too many calls or emails from its partners.

• On Insurify, Otto Insurance has a rating of 3 out of 5 stars based on 1 review. The reviewer says that Otto Insurance was easy to use and provided good quotes for his home insurance.

• On BBB, Otto Insurance has no rating or accreditation. However, it has 1 complaints filed against it in the last 3 years. The complaint says that Otto Insurance sold the customer’s personal information to multiple companies without his consent.

What states does Otto Insurance cover?

Otto Insurance covers all 50 states in the US. However, the availability and price of the quotes may vary depending on your location and the partner’s license. Therefore, you should always check with the partner before purchasing a policy.

The pros and cons of Otto Insurance

Otto Insurance has some pros and cons that you should consider before using its service. Here is a table that summarizes them:

PROS

- Option to receive quotes from many providers

- The process to request quotes is quick

CONS

- No option to view quotes on the site

- Personal information is shared with third parties, which could result in unwanted calls or emails